In the intricate world of project management, where each decision can lead to a myriad of outcomes, the ability to forecast and manage potential risks is invaluable. Enter Decision Tree Analysis, a robust tool that, quite literally, helps you see the forest for the trees. This analytical technique allows project managers and decision-makers to visually map out and understand the complexities of decisions, along with their possible consequences.

How to Perform Decision Tree Analysis

Here's a step-by-step guide on how to perform decision tree analysis for quantitative risk analysis.

1. Define the Decision Problem

Clearly state the primary decision that needs to be made, such as choosing a development methodology, selecting a software tool, or deciding on a feature set. Next, define what you are trying to achieve with this decision (e.g., minimize cost, reduce time).

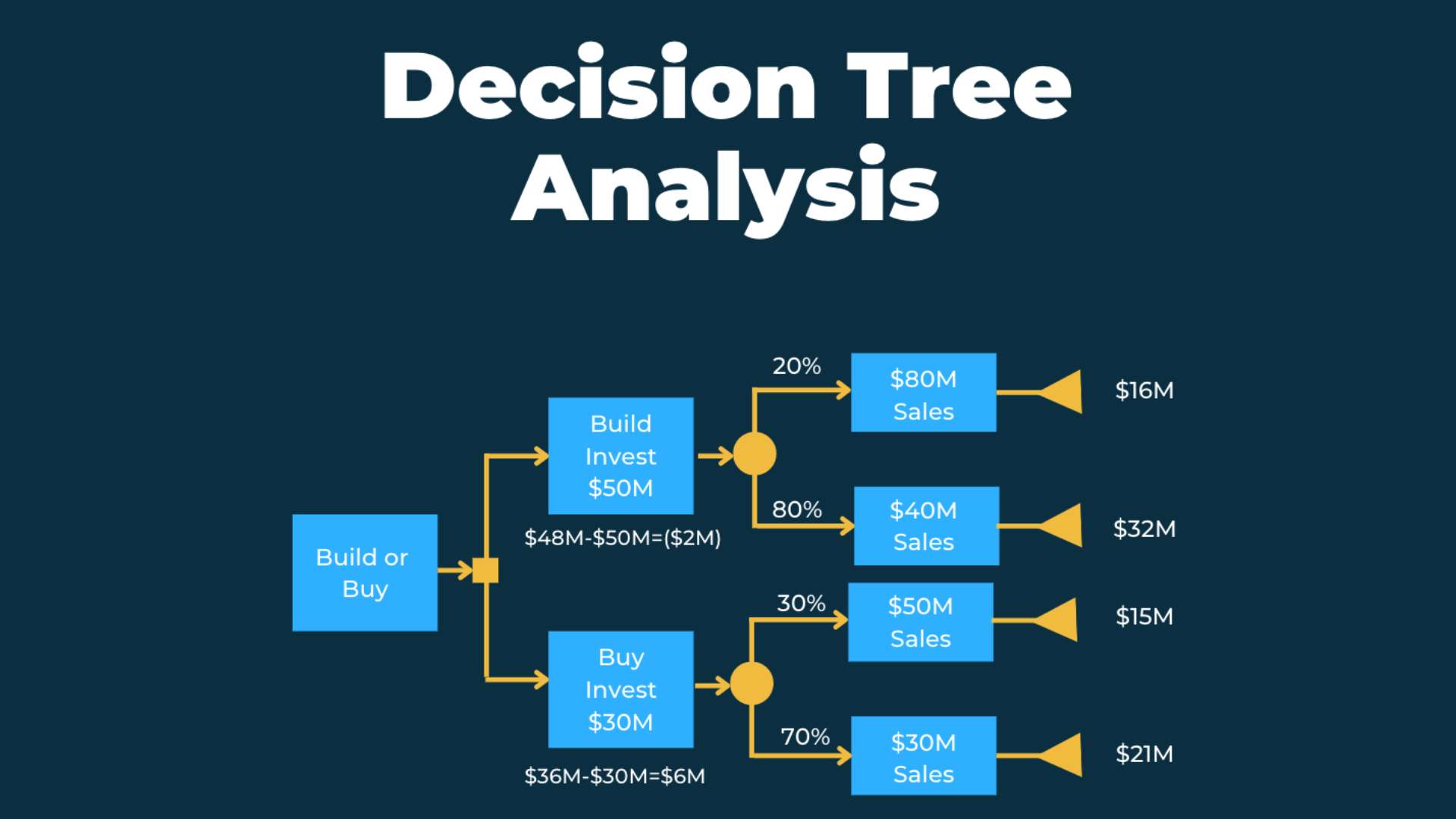

2. Structure the Decision Tree

- Draw a Square: Start your tree with a square to represent the decision point.

- Add Branches for Options: From this square, draw branches for each possible decision option or path.

- Add Circles for Uncertainty: At the end of each decision branch, draw a circle to represent uncertain future events or risks.

- Add Outcome Branches: From each circle, draw branches for each possible outcome of the uncertain event.

- Assign Probabilities: Estimate the likelihood of each uncertain event occurring and assign a probability to each branch.

3. Estimate the Outcomes

4. Calculate the Expected Monetary Values (EMVs)

5. Analyze the Decision Tree

Look at the EMVs and other outcomes for each path to determine which one best meets your objectives.

6. Make a Decision

Based on the analysis, choose the path with the optimal balance of risk and reward according to your project's objectives.

Decision Tree Analysis Example

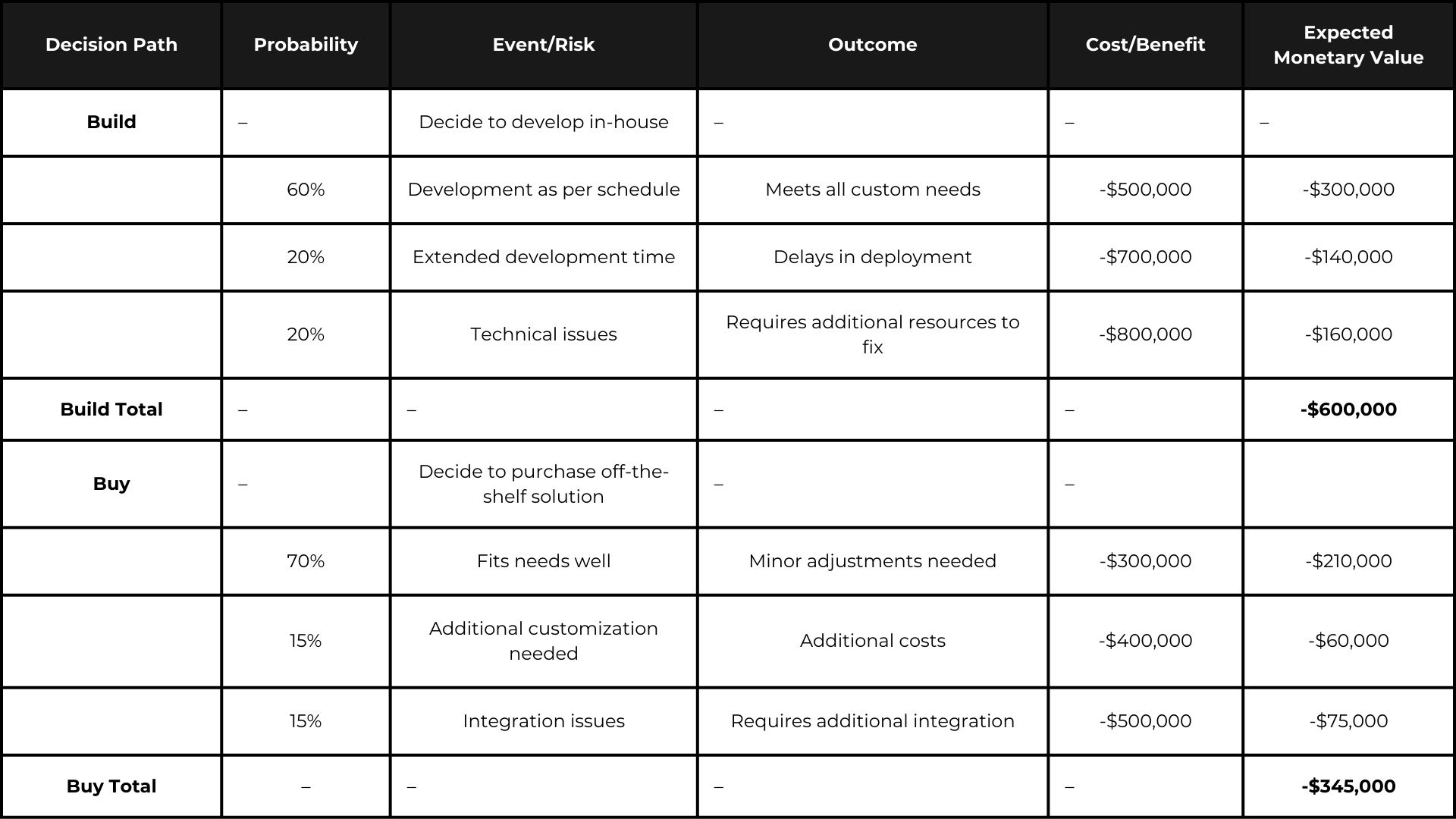

A decision tree can be represented in a table format by listing out the decision paths, their respective probabilities, outcomes, and the associated costs or benefits. Here's a simplified version of how a decision tree used to determine whether to build or buy a software solution.

Here are some other examples of using decision tree analysis:

- Evaluating vendor proposals

- Go/No-Go Decisions at project milestones

- Contingency reserve analysis

- Change request evaluation

- Choosing development lifecycles (e.g., waterfall, hybrid, or waterfall)

Explanation

- Decision Path: The major decisions being considered (Build in-house vs. Buy off-the-shelf).

- Probability: The likelihood of each subsequent event or risk occurring after a decision is made.

- Event/Risk: The specific events or risks that might occur under each decision.

- Outcome: The result of each event or risk happening (e.g., meets needs, delays, additional costs).

- Cost/Benefit: The cost or benefit associated with each outcome (negative for costs, positive for benefits).

- Expected Monetary Value (EMV): The outcome value multiplied by its probability (a measure of the weighted average outcome for that decision path).

This table helps to visualize and compare the potential costs and benefits of building software in-house versus buying an off-the-shelf solution. It considers various probable scenarios and their financial implications, aiding decision-makers in understanding the potential risks and rewards associated with each option.

PMI-RMP EXAM PREP COURSE

In this course, you will go from feeling unsure to feeling confident about key concepts of risk management, the risk management life cycle framework, the practical application of risk management, and taking the PMI-RMP® exam.